Hi, I am Trung👋

Thank you for stopping by.

I am the author of Sleep Well Investments.

You may have come across my tweets, 100+ investing articles on SeekingAlpha, or the podcast interview that has reached hundreds of thousands of readers.

What is Sleep Well Investments?

Sleep Well Investments research lesser known market leaders and owns them when the right price comes.

Identifying a great business is complex. Monitoring to own it for decades is even more difficult. And you are busy.

I am here to provide in-depth analyses of lesser-known market leaders (ESG compliant) that have survived multiple market cycles and have the ingredients to remain leaders. I also provide thesis-tracking updates to help you monitor their performance. When the right price comes, I buy them for the Sleep Well Portfolio, which I am building for my 4-year-old daughter to redeem in 2037. I disclose detailed reasoning of all BUY and SELL (ideally never) transactions (1st, 2nd, 3rd, and 4th).

Join me in building generational wealth.

If you’re an investor, hedge fund analyst, or entrepreneur, I will equip you with the knowledge and understanding of these top businesses and industries to capitalize on the future.

Three Types of Writeup:

First, the deep dives are ten thousand-word analyses for each market leader. It unpacks their exceptional strategies, tactics, and secrets. At the end of the deep dive, I test them on my ‘sleep well investments’ checklist and present a scorecard.

A high-scoring business will earn a position in my Sleep Well Portfolio, which I share with annual paid subs. You can expect a breakdown of (i) how the business has survived, (ii) how it overcomes competition and future adversities, and (iii) a comprehensive valuation to ensure a high margin of safety.

Below are the scores of the first few picks. Notice that business quality (17/20 total points) is more important than valuation (3/20 total points). The margin of safety for me comes mostly from the resiliency of the business than the cheapness of it.

As they progress, they must perform and adapt to stay on as sleep-well investments, which comes to the second type of writeup - Thesis Tracking updates.

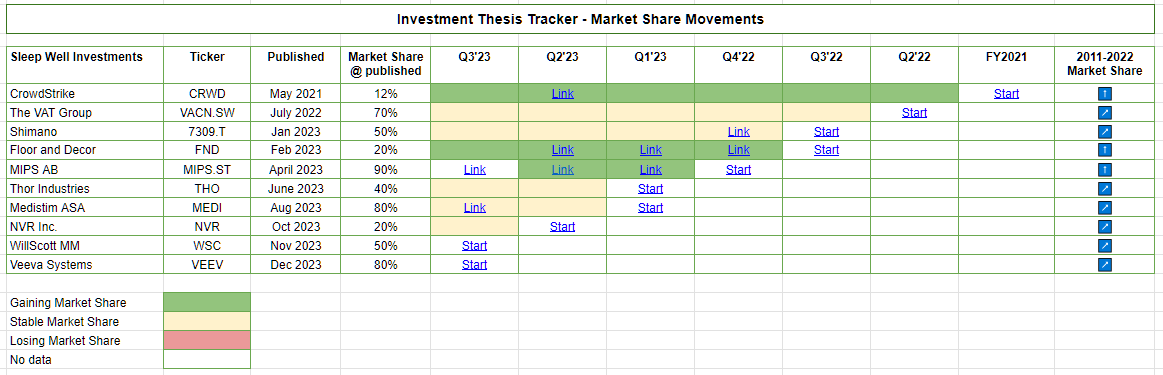

I provide a quarterly thesis tracker report to track picks’ performance. It updates moats and market share movements against key rivals. I boil the analysis down to one KPI - market share movements, as shown in the following table, green means gaining market share, red means losing, and yellow means stable - keeping things simple and effective because gaining or losing market share speaks volumes about the quality of the moats and barriers to entry. It also encourages long-term investors to think long-term!

Behind the KPI is a comparative report of (i) revenue growth, (ii) major client wins/losses, (iii) industry rankings, and sometimes (iv) product reviews, if relevant. You will know the market share movements and the why and how they gain/lose.

I encourage you to check out the thesis tracking updates of MIPS, CRWD, and FND to appreciate the breadth and depth of my research.

Sleep Well Portfolio *Live Trade Alert*

For full transparency and disclosure, I also share my position in the businesses I write about. This is the third type of write-up where I show you my detailed thought process behind every BUY and SELL. Here is the link to the 1st, 2nd, 3rd, and 4th *Live Trade Alert* for your consideration.

Expect periodic buys and very infrequent sales - ideally never. I aim to own these businesses as long as they perform in my Thesis Tracker, which I update quarterly or when data is available.

Please click this LINK to see the Sleep Well Portfolio in full.

What is the Sleep Well Portfolio?

I use my daughter’s junior portfolio to show you how I construct a long-term portfolio from scratch. Note the redemption year is 2037, 14 years from today when she turns 18.

✔ The portfolio will eventually consist of 20 names

✔ The portfolio redemption year is 2037. We buy to own long-term

✔ No market timing. We buy at a price that offers a healthy margin of safety

✔ The portfolio only invests in deep-dived stocks that are monitored closely

✔ They are market leaders who have:

Stable / strengthening market position

Enduring competitive advantages

Management with aligned interests and a strong capital allocation track record

Anti-fragility attributes (healthy balance sheet, adaptable business model, endured competitors and past crises)

Plenty of reinvestment opportunities

Trading at a fair valuation

Investing is a life-long journey, not a sprint. That’s why the portfolio redemption year is 2037. I intend to buy to own long-term. No short-term trades. No ‘if’ a certain event happens then it will work out kind of bets. I will not trade my quality sleep for a shot at gaining a few percentage points. This is a lifetime journey of building good habits and a sound investment process.

For this reason, access to the portfolio is only available for annual paid subs who are in it for the long run. I apologize to monthly subscribers; I don’t want to mislead or tag you along for the marathon when you are looking for a sprint. You still have full access to my deep dives and thesis-tracking updates.

Important note: It doesn’t matter if you manage a $50K or a $50M portfolio; if you can’t manage the small amount responsibly, then managing $50M will magnify your mistakes. Hence, I do not provide ownership details in absolute $ value.

The purpose of showing how I manage my daughter’s and my family's portfolio is to encourage long-term ownership, showing I eat my own cooking and, for your reference, that it is possible to have a lasting investment process over multiple cycles. Please don’t copy it blindly; your saving is finite; treat it responsibly. We also likely have very different financial goals and circumstances.

Finally, I will only reveal new Sleep Well Portfolio positions after publishing my deep dive. I believe an investor should only consider an investment after thoroughly researching it.

Become a member

Sleep Well Investments newsletter aims to bring you the most thorough research on market leaders. Sleep Well Investments community endeavors to connect you with family offices, investors, and analysts who can help take your learning to new heights.

For annual subs, you have additional access to the following:

Research list

Sleep Well Portfolio

Thesis tracking summary

Ownership status of SWIs in my family portfolio

If you’ve been looking to broaden your investment universe, make meaningful connections, and accelerate your career development, this is the place for you.

Expensing the newsletter

Great news! As soon as you become a paying member, you’ll be emailed a receipt that can be used to expense the cost of your subscription. Joining the Sleep Well Investments paying tier can help you accelerate your career by expanding your professional network, improving your knowledge, and unlocking access to expert talks. We’d love to welcome you aboard!

The best of Sleep Well Investments

I cover a range of sectors that are least likely to lose relevance, including semiconductors components, bike and helmet components, RVs, surgical equipment, cybersecurity software platforms, home building materials, and more. You can find all the topics that we cover here. All businesses are ESG compliant.

CrowdStrike - Cloud security leader +27% CAGR since IPO

The VAT Group - Vacuum valve leader +32% CAGR

Shimano - Bike component leader +12% CAGR

Floor and Decor - Future leader in hard-surface flooring +30% CAGR

MIPS - Helmet safety leader +45% CAGR

Thor Industries - RV leader +14% CAGR

Medical device leader +17% CAGR

NVR - Top US East Coast Hombuilder +30% CAGR

Circle Business Leader [Part 1, Part 2] +24% CAGR

Veeva Systems - Leader in Life Science [Part 1, Part 2] +43% CAGR

ESG compliant

CrowdStrike - ESG report

VAT Group - ESG report

Shimano - ESG report

Floor and Decor - ESG report

MIPS - ESG report

Thor Industries - ESG report

Medistim - ESG report

NVR Inc - ESG report

WSC - ESG report

VEEV - ESG report

About Me

I was born in Vietnam and moved to the U.K. in 2001 when I was 15. My background is in management and finance.

I am an ex-PwC and KPMG accountant, a Ph.D. doctorate in SME Innovation Management, and a passionate learner of time-tested businesses. I used to host a Value Investing group in London (pre-covid) and managed external capital for family and friends. Since 2022, I have been writing on Sleep Well Investments full-time; it’s my second baby, besides my beautiful 4-year-old daughter.

I strive for simplicity and structure in my investment process because building wealth is building time for what matters most in your life.

Feel free to contact me at trung.nguyen@sleepwellinvestments.com, LinkedIn, or twitter/X@ DTF_Capital

Don’t be a stranger!

My investment philosophy

Being optimistic and patient are superpowers.

I’m a business-focused investor with a long time horizon.

I invest in a business to own it. I rarely ever sell. Instead, I stop adding to positions that turn against me.

I hold about 20 stocks at a time. I start with small positions and let the portfolio concentrate over time without rebalancing. I invest when the price is right and add fresh savings to the stock market across large caps and individual stocks.

My investment moto is:

Study market leaders.

Track them thoroughly.

Own them for decades.

What makes a business leader in their market?

I hope we can figure it out as we break down their business and track their performance together!

Sponsorships

Interested in collaborating? Sleep Well Investments is read by decision-makers across finance, tech, and business. That includes the C-Suite of public and private companies, funds, family offices, and CIOs worldwide.

We'd love to hear from you if you want to learn more. Send us a note at trung.nguyen@sleepwellinvestments.com, and we’ll respond!

Affiliate partnership

Use the ‘SWI20’ code at checkout for discounts - Quartr is a searchable database of slides, interviews, and earnings calls. It helps me to gather relevant and valuable insights efficiently.

Testimonials

Thank you for supporting my work!

Sleep Well Investing!